Base Investments: A Comprehensive Guide For Prudent Investors

Base Investments: A Comprehensive Guide for Prudent Investors

Introduction

In the realm of investment strategies, base investments serve as a cornerstone for prudent financial planning. They offer stability, income generation, and long-term growth potential, making them an essential component of any well-diversified portfolio. This comprehensive guide will delve into the intricacies of base investments, empowering investors with the knowledge to make informed decisions and navigate the financial landscape with confidence.

Definition and Characteristics of Base Investments

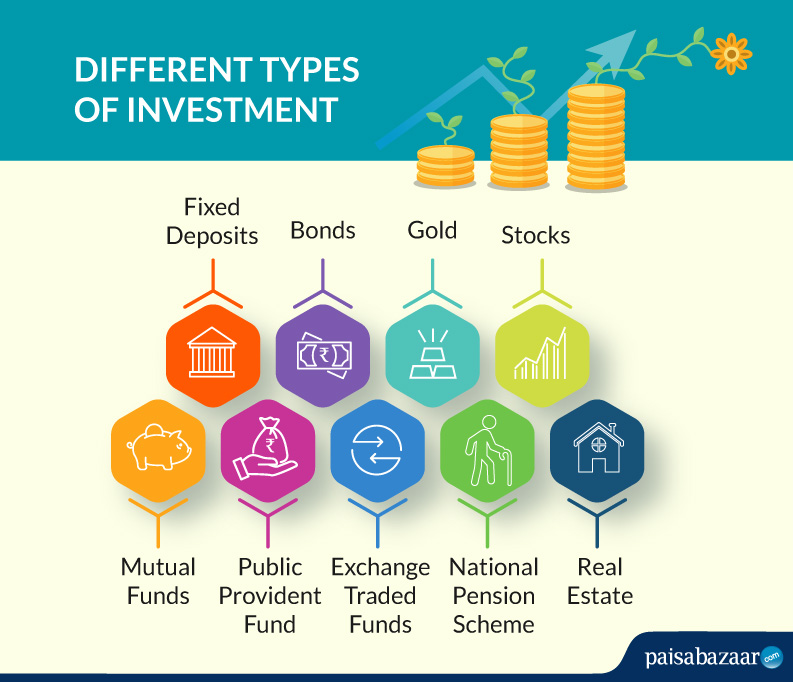

Base investments encompass a broad range of financial instruments that are characterized by their relatively low risk and stable returns. They typically include:

- Cash and Cash Equivalents: Liquid assets such as checking and savings accounts, money market accounts, and short-term Treasury bills.

- Bonds: Fixed-income securities that pay regular interest payments and return the principal at maturity.

- Preferred Stocks: Hybrid securities that combine features of both bonds and stocks, offering a fixed dividend and limited upside potential.

- Real Estate: Physical properties that generate rental income or appreciation in value.

- Commodities: Physical assets such as gold, silver, and oil that are traded on futures exchanges.

Advantages of Base Investments

- Low Risk: Base investments generally carry less risk than other asset classes, such as stocks or alternative investments.

- Stable Returns: They provide predictable income streams or capital appreciation, reducing portfolio volatility.

- Diversification: Base investments can help diversify a portfolio by providing exposure to different asset classes and reducing overall risk.

- Liquidity: Many base investments, such as cash and bonds, are highly liquid, allowing investors to access their funds quickly if needed.

- Inflation Protection: Certain base investments, such as real estate and commodities, can provide some protection against inflation by increasing in value over time.

Types of Base Investments

Cash and Cash Equivalents:

- Checking and savings accounts

- Money market accounts

- Short-term Treasury bills

- Certificates of deposit (CDs)

Bonds:

- Government bonds (e.g., Treasury bonds, municipal bonds)

- Corporate bonds (e.g., investment-grade bonds, high-yield bonds)

- International bonds

Preferred Stocks:

- Cumulative preferred stocks

- Non-cumulative preferred stocks

- Convertible preferred stocks

Real Estate:

- Residential properties (e.g., single-family homes, apartments)

- Commercial properties (e.g., office buildings, retail stores)

- Industrial properties (e.g., warehouses, factories)

Commodities:

- Precious metals (e.g., gold, silver)

- Energy commodities (e.g., oil, natural gas)

- Agricultural commodities (e.g., wheat, corn)

Investment Strategies for Base Investments

- Asset Allocation: Determine the appropriate allocation of base investments within a portfolio based on individual risk tolerance and investment goals.

- Diversification: Spread investments across different types of base investments to reduce risk and enhance returns.

- Dollar-Cost Averaging: Invest a fixed amount of money in base investments at regular intervals to reduce the impact of market fluctuations.

- Rebalancing: Periodically adjust the portfolio’s asset allocation to maintain the desired risk-return profile.

- Tax-Advantaged Accounts: Utilize tax-advantaged accounts, such as IRAs and 401(k)s, to maximize returns and minimize taxes.

Risks Associated with Base Investments

- Inflation Risk: Base investments with fixed returns may not keep pace with inflation, eroding their purchasing power over time.

- Interest Rate Risk: Bonds and other fixed-income investments are sensitive to interest rate changes, which can affect their value.

- Credit Risk: Bonds and preferred stocks carry the risk of default, where the issuer fails to make interest or principal payments.

- Market Risk: Real estate and commodities can experience market fluctuations, leading to potential losses.

- Liquidity Risk: Some base investments, such as real estate, may have limited liquidity, making it difficult to access funds quickly.

Conclusion

Base investments play a crucial role in building a solid financial foundation. They provide stability, income generation, and long-term growth potential while mitigating risk. By understanding the different types of base investments, their advantages, and the associated risks, investors can make informed decisions and construct a well-diversified portfolio that aligns with their financial goals. Remember, prudent investment strategies and regular portfolio monitoring are essential for maximizing returns and achieving financial success over the long term.

FAQs About Base Investments

What is a base investment?

A base investment is a type of investment that provides a steady stream of income, typically in the form of dividends or interest payments. Base investments are often considered to be less risky than other types of investments, such as stocks or bonds, and are therefore often used as a way to preserve capital.

What are the different types of base investments?

There are a number of different types of base investments, including:

- Certificates of deposit (CDs): CDs are time deposits that are offered by banks and credit unions. They typically have a fixed interest rate and a fixed maturity date.

- Money market accounts (MMAs): MMAs are deposit accounts that offer a variable interest rate. They typically have a higher interest rate than CDs, but they also have a lower level of safety.

- Treasury bills (T-bills): T-bills are short-term debt obligations issued by the U.S. government. They typically have a maturity of one year or less and are considered to be very safe investments.

- Corporate bonds: Corporate bonds are debt obligations issued by corporations. They typically have a longer maturity than T-bills and are considered to be more risky, but they also offer a higher potential return.

What are the risks of base investments?

The main risk of base investments is that they may not provide a high enough return to keep up with inflation. In addition, some base investments, such as corporate bonds, may be subject to credit risk, which is the risk that the issuer of the investment will default on its obligations.

How can I choose the right base investment for me?

The best base investment for you will depend on your individual circumstances and investment goals. Some factors to consider include:

- Your risk tolerance: How much risk are you willing to take?

- Your investment horizon: How long do you plan to invest for?

- Your financial goals: What are you trying to achieve with your investment?

Once you have considered these factors, you can start to narrow down your choices and choose the base investment that is right for you.

Also read: Mengenal Lebih Dekat Jilbab Rabbani Sejarah